The average rate of depreciation in value of a laptop is 10% per annum. After three complete years its valuewas ksh 35,000. Determine its value at the start of the three-year period.(3marks) -

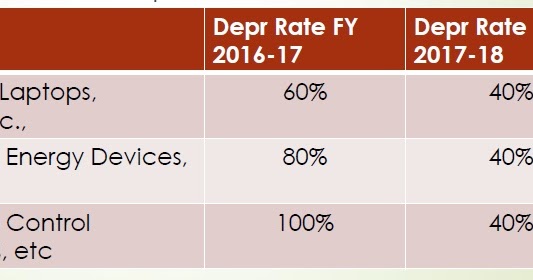

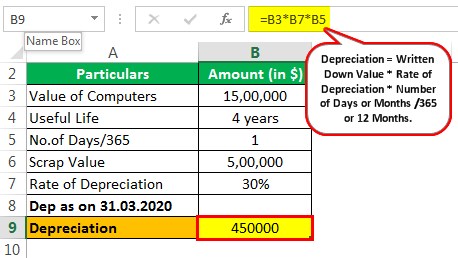

SOLVED: The depreciation rate of a laptop computer is 40% per year: If a new laptop computer was purchased for $1,200, find a function that gives its value t years after the

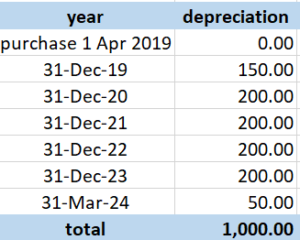

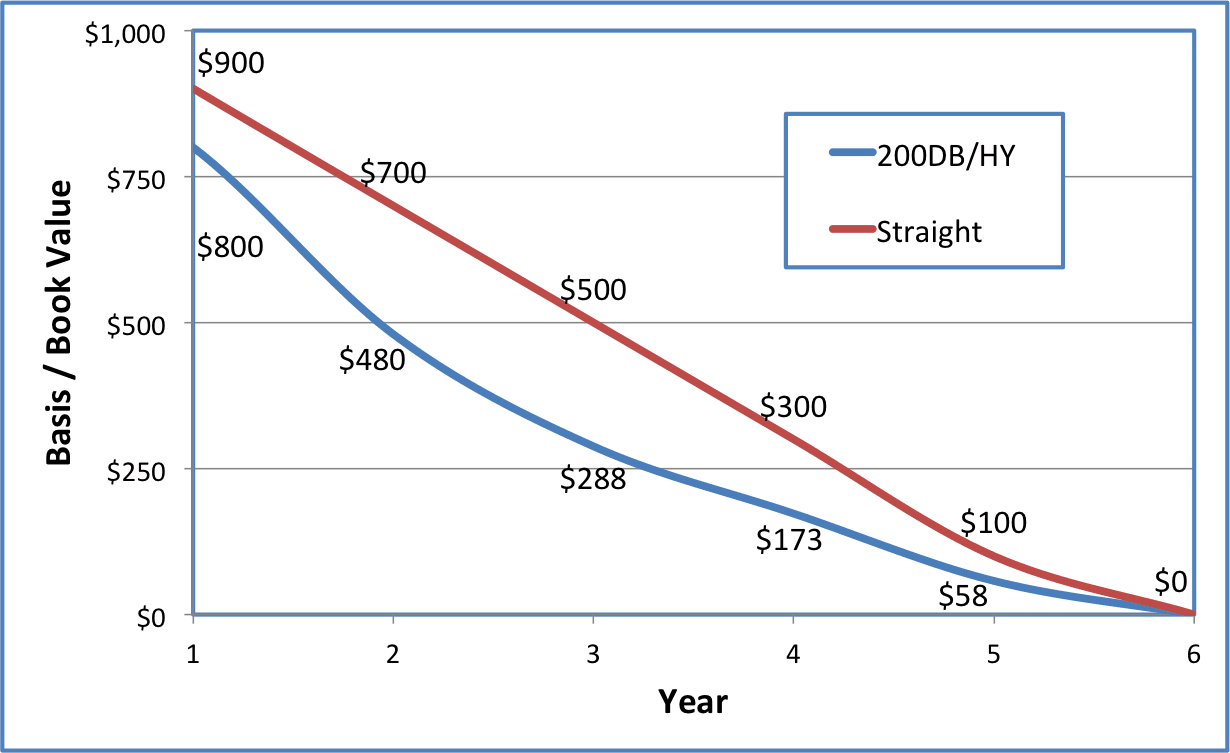

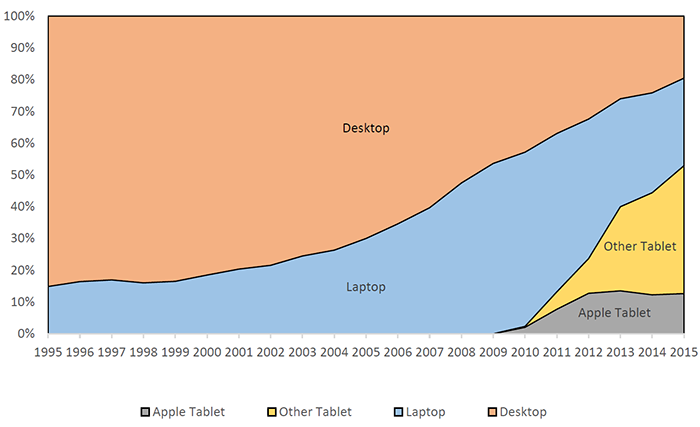

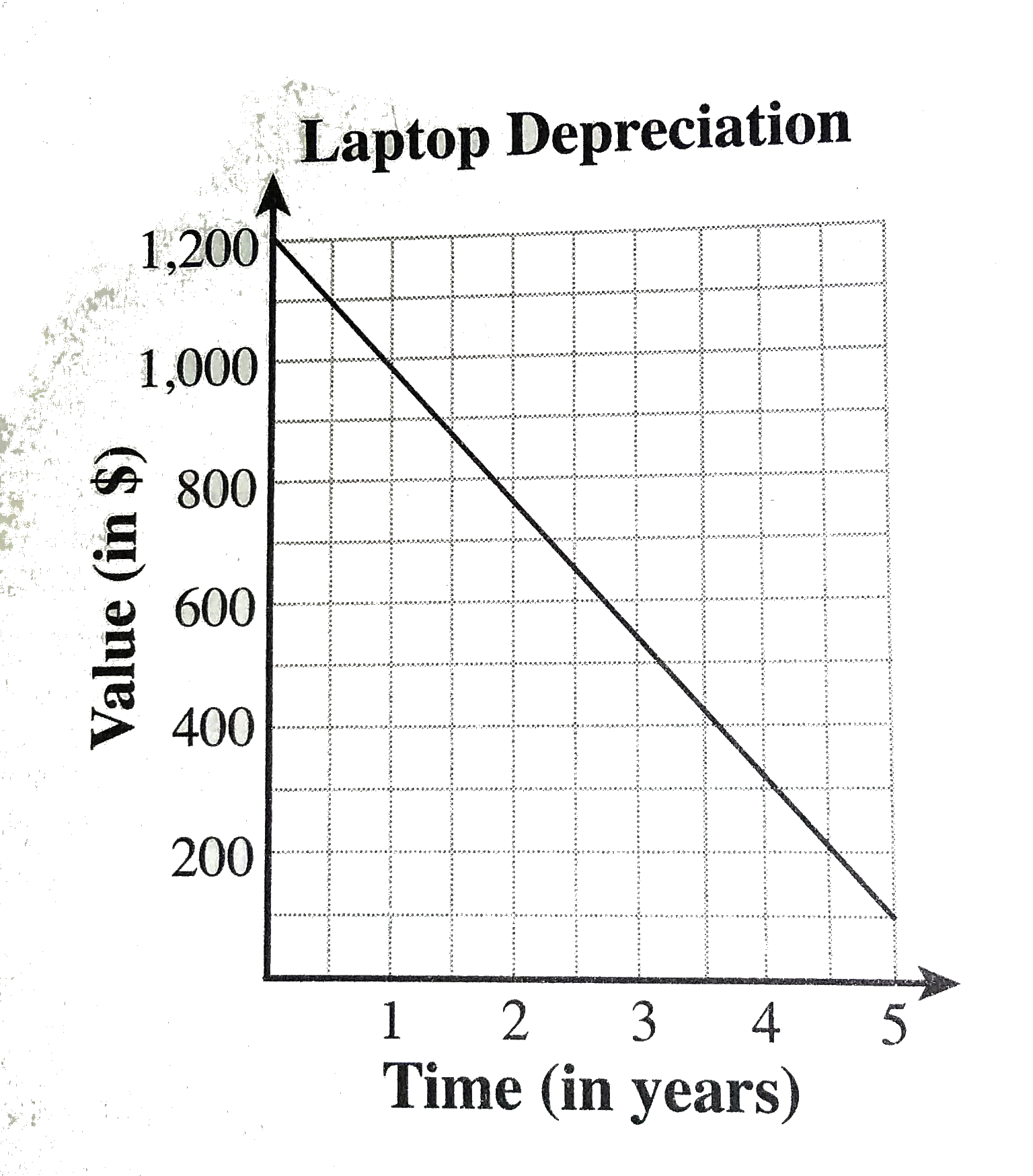

The figure above shows the straight-line depreciation of a laptop computer over the first five years of its use. According to the figure, what is the average rate of change in dollars

SOLVED:The figure above shows the straight-line depreciation of a laptop computer over the first five years of its use. According to the figure, what is the average rate of change in dollars